39 irs mileage rate 2022

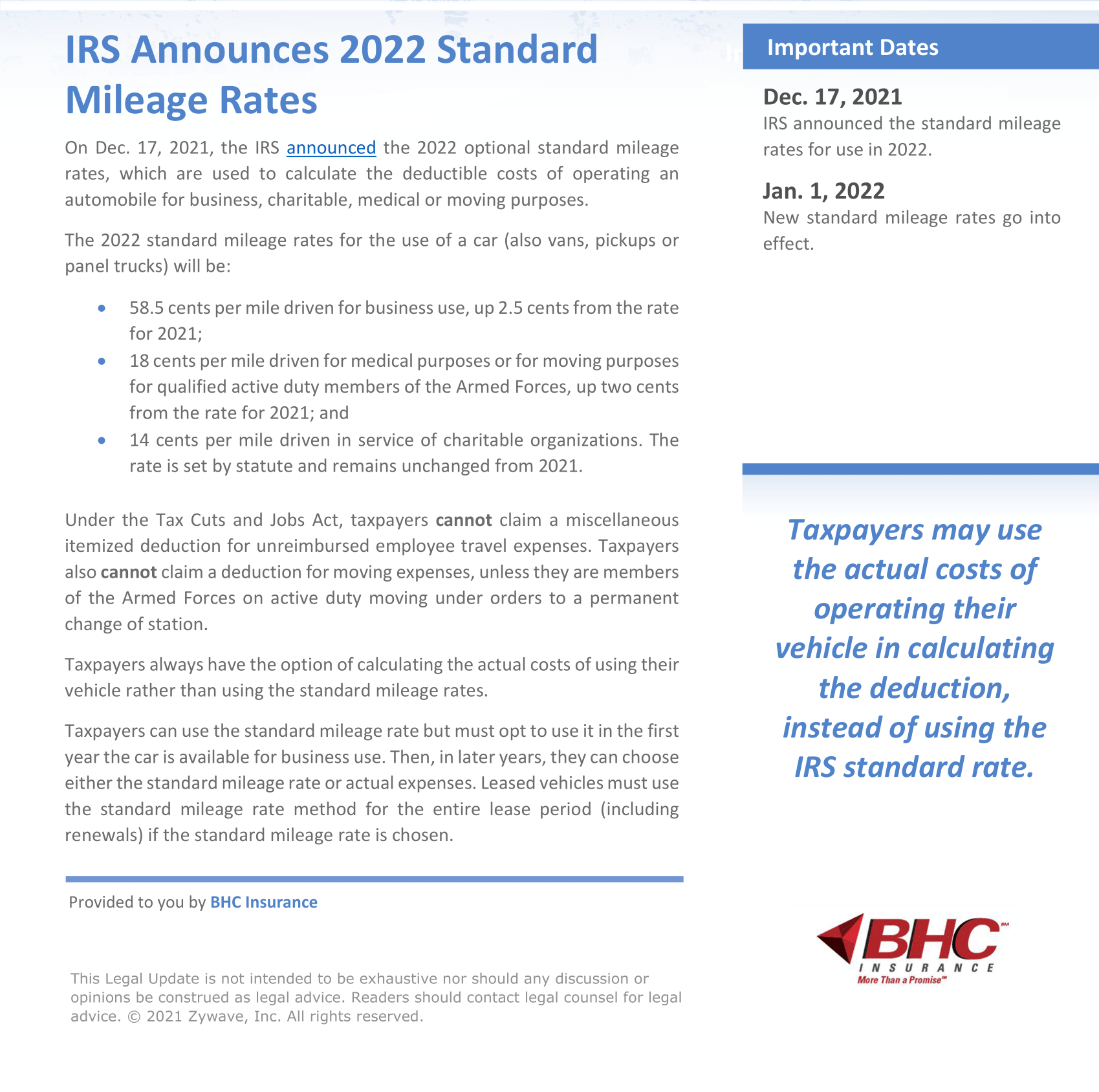

IRS Announces Mileage Rates for 2022 - mcb.cpa The IRS has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. As of Jan. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be. 58.5 cents per mile driven for business use, up 2.5 ... Tennessee Mileage Reimbursement Rate 2022 | Mileage ... Tennessee Mileage Reimbursement Rate 2022 - Mileage Reimbursement Rate 2022 - This is the typical rate set by the Internal Revenue Service (IRS) that determines the default cost per mile that employers pay employers for personal vehicle expenses that are used for business, medical, or charitable purposes. Since the rate is set every year, you might want to check out the mileage ...

Standard Mileage Rates | Internal Revenue Service Standard Mileage Rates. The following table summarizes the optional standard mileage rates for employees, self-employed individuals, or other taxpayers to use in computing the deductible costs of operating an automobile for business, charitable, medical, or moving expense purposes. Period. Rates in cents per mile. Source.

Irs mileage rate 2022

Irs Reimbursable Mileage Rate 2022 - Latest News Update The Rates Of Reimbursement For Mileage Set By The Irs To Be Used In 2021 Are: 1, 2022, the irs announced the standard mileage rate is 58.5 cents per mile. 16 cents/mile is the rate for moving and medical miles (reduced to 17 cents/mile over the last three years). IRS Announces Standard Mileage Rates for 2022 The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they ... New IRS Standard Mileage Rates in 2022 - MileageWise IRS Standard Mileage Rates for 2022: The new Standard Mileage Rates have increased from 56 to 58.5 cents per mile for business purposes, and from 16 to 18 cents per mile for medical or mobile purposes, compared to the previous year. The 2022 Standard Mileage Rates have increased due to changes in fuel prices, fuel consumption, and insurance costs.

Irs mileage rate 2022. IRS 2022 Mileage Rate IRS | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes. The rates of reimbursement for mileage determined by the IRS to be used in 2021 are: 56 cents/mile for company travel (reduced from 57.5 cents/mile in the previous year). 16 cents/mile for moving as well as medical travel (reduced from 17 cents/mile in these three years). IRS mileage rates for 2022 | Cornell University Division ... The Internal Revenue Service has issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical, or moving purposes. Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) are as follows: IRS Announces 2022 Mileage Reimbursement Rate Here are the 2022 IRS mileage reimbursement rates for businesses, individuals, and other organizations: 58.5 cents per mile driven for business use. This is an increase of 2.5 cents from the 2021 ... IRS issues standard mileage rates for 2021 | Internal ... Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile driven for business use, down 1.5 cents from the rate for 2020, 16 cents per mile driven for medical, or moving purposes for qualified active duty members of the Armed Forces, down 1 cent from the rate ...

What is the IRS Mileage Rate for 2022? - File My Taxes Online The IRS has released the 2022 optional standard mileage rates, which are used to determine the deductible expenses of driving a car for business, charity, medical, or relocating reasons. The federal mileage rates for an automobile (including vans, pickups, or panel trucks) will be as follows beginning January 1, 2022: 58.5 cents per mile driven ... The 2022 IRS Mileage Rate and Your Business The 2022 IRS mileage rate of $.585/mile was derived from a blend of vehicle cost factors averaged out from across the U.S from 2021, including average gas prices, insurance costs, and depreciation for a vehicle driven an average number of miles. This means IRS standard mileage rate does not represent actual vehicle ownership and operation costs ... IRS provides tax inflation adjustments for tax year 2022 ... The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Marginal Rates: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly). Mileage Rate For 2022 | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes. The rates of reimbursement for mileage established by the IRS for 2021 are: 56 cents/mile for business mileage (reduced from 57.5 cents/mile during the previous year). 16 cents/mile for moving and medical miles (reduced by 17 cents per mile since the last three years).

2022 Mileage Rate | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes. The reimbursement rates for mileage that are standard set by IRS for 2021 are: 56 cents/mile for business miles (reduced by 57.5 cents/mile in the prior year). 16 cents/mile for moving or medical mileage (reduced by 17 cents per mile over these three years). Irs Mileage Rate 2022 Calculator - Latest News Update The Rates Are Typically Marginally Lower Compared To The 2020 Prior Year. It is almost certain that there is going to be an adjustment to the 2022 irs mileage rate calculator, as it does with the previous years. 1, 2022, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 58.5 cents per mile for business purposes; IRS Mileage Rates For 2022 | Mileage Reimbursement Rate ... The IRS Mileage Reimbursement Rate 2021 & 2022. It's not yet be possible to compare the mileage reimbursement rates of 2021 and 2022 because these rates 2022 aren't yet announced. The year 2021 the typical mileage rates are: For medical-related trips: $0.16/mile. Active-duty Armed Forces who are moving: $0.17/mile. IRS Raises Standard Mileage Rate for 2022 The standard mileage rate that businesses use to pay tax-free reimbursements to employees who drive their own cars for business will be 58.5 cents per mile in 2022, up 2.5 cents from 2021, the IRS ...

2022 IRS Mileage Rate 2022 | Mileage Reimbursement Rate ... 2022 IRS Mileage Rate 2022 - Mileage Reimbursement Rate 2022 - The mileage reimbursement rate is the normal rate set by the Internal Revenue Service (IRS) which determines the default price per mile provided by the employers for personal vehicle expenses that are used to meet medical, business or charitable purposes. As the rate is adjusted each year, you might want to check out the ...

2022 IRS Mileage Rate 2022 | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes. The rates of reimbursement for mileage determined by the IRS in 2021 are: 56 cents/mile for business miles (reduced by 57.5 cents/mile in the prior year). 16 cents/mile for moving as well as medical travel (reduced to 17 cents/mile over these three years). 14 cents/mile for volunteer mileage ...

2022 IRS Mileage Rate: What Businesses Need to Know 1. The Price of Gas. While there are more expenses to driving than just fuel costs, they still play a significant role in calculating the 2022 IRS mileage rate. Fuel can make up as much as 23% of driving costs, and while most of the components of gas prices are typically stable, crude oil prices change daily and are the main influencer of ...

IRS Raises Standard Mileage Rates for 2022 | - CBIA Standard mileage rates are up slightly from 2021 in two categories, according to the IRS. Beginning Jan. 1, 2022, the standard mileage rates for using a car, van, pickup, or panel truck will be 58.5 cents per mile for work use. The rate is up 2.5 cents from 2021, but only half of a cent from 2019, when it was 58 cents.

IRS Mileage Rates for 2022: What Can Businesses Expect For ... The IRS officially published its optional standard mileage rates for 2022 on December 17th: . 58.5 cents per mile driven for business purposes (up 2 cents in comparison to 2021 rate) 18 cents per mile driven for medical/moving purposes (up 2 cents from the 2021 rate) The rate per mile driven in service of charitable organizations is set by ...

IRS Mileage 2022 | IRS Mileage Rate 2022 IRS Mileage Rate 2021 & 2022 for Different Purposes. The standard reimbursement mileage rates established by the IRS to be used in 2021 are: 56 cents/mile for company miles (reduced from 57.5 cents/mile in the previous year). 16 cents/mile for travel or medical mileage (reduced to 17 cents/mile over the last three years).

IRS issues standard mileage rates for 2022 | Internal ... IR-2021-251, December 17, 2021. WASHINGTON — The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. Beginning on January 1, 2022, the standard mileage rates for the use of a car (also vans ...

Standard Mileage Allowance Rates for 2022 - Administrative ... New Mileage Rate for 2022. The new rate for business miles driven for travel taking place on or after January 1, 2022, is $0.585 per mile , a decrease from $0.56 in 2021. The 2022 mileage rate will automatically show in the travel and expense reimbursement system (Concur) effective Jan. 1, 2022.

New IRS Standard Mileage Rates in 2022 - MileageWise IRS Standard Mileage Rates for 2022: The new Standard Mileage Rates have increased from 56 to 58.5 cents per mile for business purposes, and from 16 to 18 cents per mile for medical or mobile purposes, compared to the previous year. The 2022 Standard Mileage Rates have increased due to changes in fuel prices, fuel consumption, and insurance costs.

IRS Announces Standard Mileage Rates for 2022 The Internal Revenue Service (IRS) just released standard mileage rates that taxpayers must use when filing 2022 income taxes in 2023 if they are claiming a mileage deduction for a vehicle they ...

Irs Reimbursable Mileage Rate 2022 - Latest News Update The Rates Of Reimbursement For Mileage Set By The Irs To Be Used In 2021 Are: 1, 2022, the irs announced the standard mileage rate is 58.5 cents per mile. 16 cents/mile is the rate for moving and medical miles (reduced to 17 cents/mile over the last three years).

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/DYKCU2U3QNHSJKUWMJB56SEO4Q.jpg)

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

0 Response to "39 irs mileage rate 2022"

Post a Comment